Salesforce launches its Customer Data Platform

Last week Salesforce announced the upcoming general availability of Digital 360, their entry in the Customer Data Platform market. The CDP market has grown increasingly saturated over the last few years with each of the major Marketing Technology providers having thrown their hat into the ring with Adobe announcing Adobe Experience Platform, Oracle launching CX Unity, and Acquia acquiring AgilOne. No sooner had I written this opening paragraph than SAP announced they were buying Emarsys.

CDP’s have been around for more than a decade but began increasing in popularity in 2016 when more than two dozen different players began gaining market share particularly in highly B2C focused industries who deal in large volumes of transaction, demographic and behavioral data. Adoption grew swiftly across Retail, Restaurants, Travel & Hospitality, Media & Entertainment, etc.

Where CRM has historically focused on B2B Sales and more single-channel management, CDP’s were designed from the ground up to be a unified customer profile for B2C like volumes ingesting and processing real-time data from call center interactions, connected device data, product usage data, sales data, mobile apps, customer life cycle trends, websites, social media, and email (see Figure 1-1).

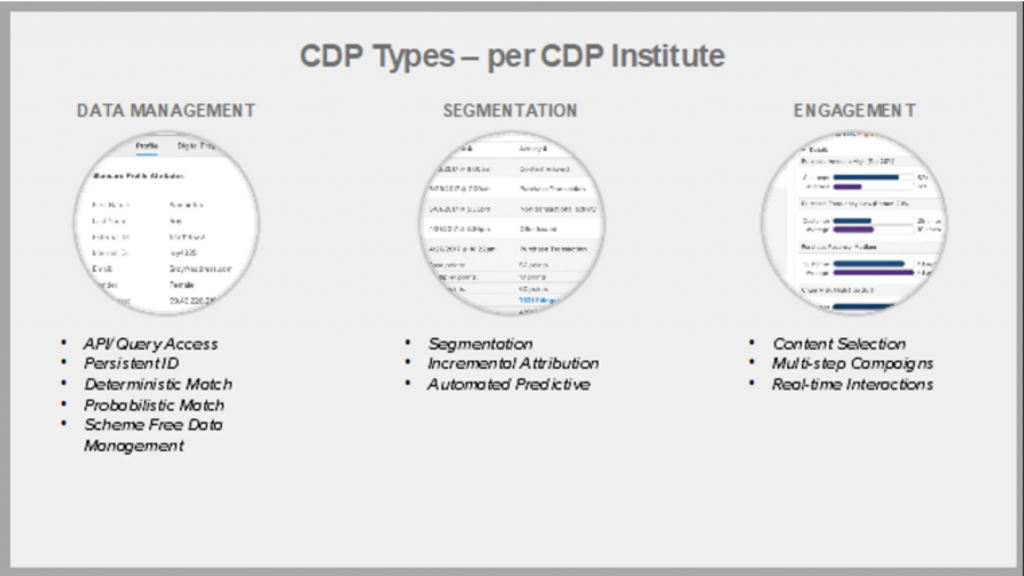

The CDP Institute has sought to categorize the solutions in marketing into three primary categories, Data Management, Segmentation, and Engagement CDPs.

Figure 1-1

* Image provided by Elevate Digital

It will be interesting to see where Salesforce takes this initial iteration of their CDP. The company that has defined the modern SAAS CRM market, won’t move away from their core platform being the single version of truth for a customer profile, meaning it looks like their notion of a CDP will be:

1. A data aggregation point for high volume transaction and demographic data – where data volume exceeds core CRM’s capabilities.

2. Their focal point for defining audiences and segments and engaging those segments through their various clouds.

3. A likely beneficiary of Einstein calculated machine learning values Customer Lifetime Value, Recency, Frequency and Spend metrics, Churn and Churn Propensity modeling, etc.

Leveraging their CDP for these gaps in their existing cloud capabilities could be a home run. Salesforce already has the last mile engagement layers well covered with the likes of Marketing Cloud, Commerce Cloud, and Service Cloud.

Their strength in these core Martech workloads is also part of the challenge. How their CDP integrates and coexists with heterogenous environments and non-Salesforce platforms will be the biggest obstacle to real enterprise value.

1. How will Salesforce handle the integration with thousands of relevant platforms from Point of Sale systems to custom mobile applications? Will they establish a connector framework?

2. Will Salesforce provide industry-specific data models and data mapping routines to simplify time to value? This has been a pervasive challenge for years in the CDP industry.

3. Will they establish a model for publishing audience/segment data to non-Salesforce platforms for consumption?

With each of the Martech superpowers establishing their CDP and positioning their CDP’s as the glue to connect their solutions into a cohesive platform, the potential for another challenge exists. Will large enterprises that have invested in multiple solutions stacks, like Salesforce and Adobe find themselves being forced to deploy, support, and then integrate multiple Customer Data Platforms?

As always, we will be watching this unfold in real-time and provide guidance to our clients on optimal paths forward.

Adam